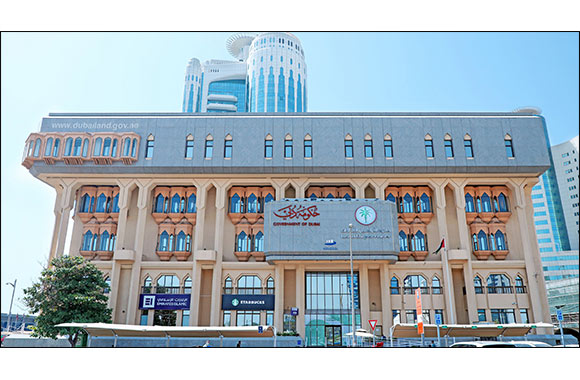

Dubai Land Department Directs Property Owners to Engage Accredited Valuation Offices for the Implementation of Corporate Tax Legislation

Dubai, United Arab Emirates, 12 November 2023: To reinforce transparency within the real estate market and promote adherence to relevant laws and regulations, Dubai Land Department (DLD) is committed to providing property owners with accessible resources. The official list of accredited companies and valuation offices is available on DLD’s official website (dubailand.gov.ae) and the Dubai REST app, all compliant with the prerequisites for implementing corporate tax per Decree Law No. 47 of 2022. These directives are thoughtfully designed to guide companies in preventing potential legal or financial infractions, thereby supporting continuous growth and contributing to the development and prosperity of Dubai’s real estate sector.

To ensure a fair and transparent approach concerning assets and liabilities and to streamline the determination of the initial budget ahead of the new system’s implementation, DLD advises referring to Ministerial Resolution No. 120 of 2023, specifically Clause 3 of Article Two, where the relevant government entities in the UAE determine the market value of eligible immovable funds.

Consulting this decision ensures a seamless transition from the period before the corporate tax law’s implementation and simplifies the process of establishing the initial budget. The Ministerial Decision will apply to specific assets and liabilities, including immovable funds, intangible assets, financial assets, and financial liabilities held by businesses before implementing the Corporate Tax Law.

Notably, the decision provides more flexibility to the real estate sector, as businesses with immovable funds calculated on the basis of historical cost can determine the basis of the facility, either using the time division method or the evaluation method. This allows groups to select the approach that best suits their needs for each asset.

Home >> Government, Legal & Humanity Section

The Glamorous Nora Fatehi to Bring Her Signature Glamour and Power Moves the To ...

Emirates commits support to Asia Rugby to broaden reach and appeal of sport in 3 ...

September startup spotlight: Five success stories from MBZUAI researchers, stude ...

Elevate Your Hair Game with the Shark® FlexStyle – The Ultimate Styling Tool in ...

Hotpack Global to offer 100 job placements to amnesty seekers

Turkish Airlines Secures First Sustainability-Linked Loan for Two Airbus A321NEO ...

Mohammed Bin Rashid Library Celebrates the Legacy of Ali Sultan bin Bakhit Al-A ...

A Royal Tribute: Amouage's Gift of Kings Collection

DPL cricket tournament season 4 is all set to kick off in October

Dubai Health Authority Launches Professional Diploma in Emergency and Crisis Hea ...

Salon du Chocolat et de la Pâtisserie Dubai Opens for its Third Edition

Emirates celebrates Oktoberfest onboard and in lounges

Mazagan Beach & Golf Resort Launches the “Sun-kissed Getaway” Offer

Emirates unveils its new lounge in London Stansted Airport

MoHAP explores avenues of boosting health collaboration with Serbia

Idea on Smart Water Conservation Solution Wins Inaugural Edition of TCS Sustaina ...

Megastar Chiranjeevi To Receive The Prestigious Iifa Utsavam Special Honour For ...

Dubai-based Toastmasters District 127 emerges No.1 globally

Ru'ya, Careers UAE 2024: Bringing young Emirati talent to a new look lineup of e ...

EDGE Entity LAHAB to Supply Ammunition for National Shooting Championship